Originally Published on bmmideas.com.

Before I begin this blog, I want to inform you about the transition of my blog from substack. If you like the content of this blog, please subscribe (no fee) to bmmideas.com for future investment ideas. I will be building a library of investment ideas and content at my website.

There is a lot that can be written about Walmart (WMT), the biggest company in the world by revenue (in a few quarters Amazon will likely displace WMT). BUT the raging debate in retail/e-commerce right now is about the impact of covid on the e-commerce businesses of the biggest brick & mortar retailers, who in past few years were trying to put up a fight against Amazon by building their own e-commerce franchise.

Prior to covid, we already had the success story of Home Depot, which demonstrated that incumbents can not only survive but take advantage of their retail footprint to effectively compete against Amazon by adopting an omni-channel strategy. It is clear today that the future of retail is omni-channel, and physical footprint can be key to bring down CAC as well as to lower the costs of last mile delivery.

All this is particularly true for Walmart, which was already making significant investments behind its omni-channel capabilities before Covid. With $64bn+ in e-commerce GMV in FY21, best of class supply chain and distribution prowess, and balance sheet strength to invest in e-commerce - covid may have set Walmart’s e-commerce flywheel in motion. Current stock valuation of <22x 2023e EPS does not adequately reflect this dynamic. Market is largely concerned about tough comps, price gaps/inflation, and e-commerce investments being drag on FCF. All that may matter over the next 6-12 months, but WMT is positioned to become a formidable e-commerce force over the next 5 years. I believe Walmart’s US e-commerce GMV can reach $100bn+ with advertising, subscription, and 3P marketplace providing higher long-run steady state FCF. Additionally, a lot of underperforming parts of international business have been culled, US store base is firing on all cylinders, and Flipkart’s potential IPO at ~$40bn valuation can be a near term catalyst.

Rather than explaining the business model of Walmart in detail, I want to focus on what matters for the stock and the key debate points that need to be answered for the stock to work in medium to long-run.

Debate #1: What is the long-run potential of Walmart’s E-Commerce Business?

Barriers to entry in the online retailing are lower than physical retailing but barriers to scale in online retailing are much higher. If this scale is combined with a repeat/organic customer base, then the unit economics of e-commerce for an omni-channel retailer can be superior than what most pureplay e-commerce players can achieve. Walmart has all the building blocks to be a dominant e-commerce franchise with huge distribution and fulfillment scale (4,700 US stores, and 770mm+ square footage), massive customer base (160 million shoppers weekly), and financial strength to invest behind creating an e-commerce ecosystem (~$30bn in Operating Cash Flows). Walmart, in many cases, is adopting Amazon’s playbook to be successful online – simply put, leveraging 1P marketplace to win customers and gain traction, using distribution scale and customer reach to create 3P marketplace, building a digital advertisement business to improve profitability and having a subscription business to generate repeat purchases and grow basket size. I elaborate on all these building blocks below:

1P Marketplace: Walmart has been experimenting with the idea of e-commerce for a long a time, but like most retailers it left the playing field largely open to AMZN for the first two decades of AMZN’s existence. It is only in 2015 (after Doug McMillon became CEO) that the focus pivoted to omni-channel strategy. As of today, WMT’s top 1 million SKUs are sold through its 1P marketplace and rest ~80 million are handled through its 3P marketplace. Walmart has been remodeling its stores to become fulfillment centers by mirroring top 230K SKUs across stores to provide expedited delivery, and the easy in-store return of items purchased online, both of which consumers value (and both are big cost centers for a pureplay e-commerce player). Moreover, BOPIS/curbside pick-up is the cheapest form of last mile delivery and WMT is playing offense in largely underpenetrated online grocery TAM by fulfilling ~33% of its e-comm orders through click & collect. I believe there is a sense of urgency at WMT to make e-comm work, grocery is too important a profit pool for WMT to cede to AMZN. In this backdrop, covid provided much needed customer trial & perhaps habit formation w/o burning billions of dollars in customer acquisition and retention costs. This trial can be immensely important for setting WMT’s e-commerce flywheel in motion and attaining profitability & liquidity for its 3P marketplace.

Potential for 3P marketplace: WMT does not disclose its 3P GMV (I expect it be ~10%), but AMZN has taught the world the importance of 3P marketplace. AMZN gets 60% of its GMV from 3P marketplace, with 3P take-rate of ~27% (30% FBA, 15% for non-FBA). Moreover, 3P can be 5x-10x more profitable than 1P. Unlike AMZN, WMT’s fulfillment business is nascent, and fulfillment will be an important determinant of size of 3P GMV in the long-run. As WMT scales its fulfillment services, there is no reason to believe that the 3P business of WMT cannot scale successfully. In fact, there will be many AMZN top sellers that would want to get access to WMT’s customer base. Merchants on 3P marketplace will also benefit from integration with the stores; especially new DTC brands, WMT can commit 3P merchants to showcase their brand in-store if the brand generates certain millions of $ in revenues on the marketplace. Similarly, WMT’s recent partnership with Shopify further demonstrate the ability of WMT to attract sellers/merchants to its platform as it scales WMT fulfillment services.

Moreover, as 3P marketplace expands, WMT will be able to earn more in advertising dollars from the merchants. Advertisement can be an important cash cow with 40%-50% EBIT margins. AMZN’s current yearly run-rate for advertising revenues stand at $28billion or ~12% of its 3P marketplace GMV. I expect WMT can have similar advertising revenue stream as Walmart.com gets its two-sided marketplace going.

Walmart+: Walmart+ does not have the bells and whistles (no prime video) of an Amazon prime, but it still provides an attractive value relative to its price of $98 a year. With unlimited next-day/2 day shipping, fuel discounts, express shipping at discounted rates, etc. Frankly, I still think Walmart+ is a half-baked subscription, and WMT will add a lot more functionalities in coming years without burning billions of dollars in developing video content. For instance, WMT can add healthcare and pharmacy services, financial products (many Walmart customers are underbanked and Ribbit can play a role in reaching these underbanked customers), etc. Walmart does not disclose # subscribers of Walmart+, but channel checks and customer surveys have indicated that Walmart+ can have 8-10 million subscribers. As WMT adds more & more benefits, the attractiveness of Walmart+ should lead to new customer addition and higher AOV. There is a concern that it took AMZN to reach $100bn in GMV to breakeven on Prime. I believe that WMT can hit breakeven on Walmart+ sooner, because: a) it is not starting from scratch (already provides financial services, healthcare and pharmacy benefits, etc.), b) AOV for grocery is higher ($100/week), which can be further enhanced by Walmart+ members buying more non-grocery items (Prime customers purchase 2.3x more products than a non-prime customer), and c) store footprint lowering the cost to serve customers.

US E-Commerce GMV Growth: Going back to my original question, what does all this tell about Walmart's e-commerce opportunity in the US.

Though it is not Day 1 anymore, e-commerce is still ~19% of retail sales (despite big covid uptick) and 9% of grocery sales. Total share of U.S e-commerce can reach 40%-50% of retail sales by 2030. Walmart, with its dominant #2 position in US e-commerce, should not only be able to participate in this growth but should be able grow ahead of the e-commerce growth rate. This should be true given its dominance and footprint advantage in online grocery, which is one of the most under-penetrated category.

I expect US e-commerce GMV for WMT to double in next 5 years and grow 10% CAGR thereafter. In 2030, e-commerce GMV can be 28% of total US sales. Lastly, as WMT scales its fulfillment business and attracts more merchants, I expect 3P to become 40% of total US e-commerce GMV.

Debate #2: Profitability and investment drag of Walmart’s e-commerce business

The whisper number for WMT’s e-commerce loses was $1bn of loss on a $21bn of US GMV in 2019 (-5% EBIT margin). In my view, revenue increases from e-commerce for leading retailers have not been at the expense of profits, to the same extent, as they were for pureplay e-commerce players. For instance, both Target and Walmart talked about significantly cutting down e-commerce loses in CY2020, with Walmart emphasizing on growing e-commerce business profitably over the next 3-4 years. Walmart is using ~3,800 of its stores to act as fulfillment center for grocery and next-day delivery.

Economically, BOPIS will always be cheaper than same day delivery and large number of consumers are highly cost sensitive (Instacart markups may not appeal to many customers). Target on its recent investor day commented about click and collect being 90% cheaper than DC fulfillment and utilizing stores to fulfill orders being 50% cheaper than shipping orders from DCs. This is a big competitive advantage, this will help WMT to save on last mile delivery costs and have better unit economics on at least 33% of its orders (or perhaps even more as it gains more share in e-commerce). Last mile delivery can cost as much as 50% of the total delivery cost when an order is fulfilled from DC.

Whether click & collect or last-mile delivery becomes the norm post-covid, WMT’s retail footprint will allow it to scale in a more capital efficient manner. Additionally, WMT is known for its lean and efficient supply chain that has enabled WMT to offer EDLP and EDLC over the past 4 decades. There will be a learning curve involved in fulfilling e-commerce orders but generating efficiencies has been part of WMT’s DNA. The profitability of e-commerce will further improve as 3P marketplace and advertising scales. Then there are other levers to improve profitability, say, by taking a bigger share in general merchandise e-commerce and increasing the AOV of Walmart+ customers.

Overall, I model ~8.5% 3P margins by 2030 (eBay generates 25% EBIT margins, AMZN has 7%-8% margins on 3P), and advertising can become $3bn EBIT business. I expect 1P to largely breakeven in 4-5 years and earn 1% EBIT margins by 2030. WMT to breakeven on US e-comm in FY2024/25 with EBIT margins reaching ~5.6% by 2030.

Investments and capex: Amazon has earned itself a coveted position where Bezos is considered one of the best capital allocators of our times. This has provided Amazon a long leash and flexibility to go out and create its distribution infrastructure. Unfortunately, Walmart has much to prove on ROIC of its e-commerce investments to its shareholder base. Most of the current Capex is getting allocated to store remodels, technology infrastructure, and building 3P fulfillment capabilities - all of which are necessary to achieve scale and profitability. In my view, the guidance of step-up in capex to $14bn (2.6% of sales) in FY22 from ~$10 bn (~2% of sales) reflects the urgency to retain and capitalize on covid driven benefits. I expect capex to stay above 2% (as % of sales) for next few years as WMT further strengthens its e-comm infrastructure. I am not particularly concerned about this step-up. These are necessary investments if WMT wants to create an AMZN like moat.

Walmart typically pays ~$6 bn in dividends and spends remaining FCF in share buybacks. Both dividend and buybacks are safe despite step-up in capex. There might be a slowdown in the growth rate of dividends/buybacks in some years, but most of the money will be spent on growth capex that can permanently alter the growth trajectory of the business.

Debate #3: Other Debate Points

This is a catch-all category. Apart from e-commerce, the core brick & mortar business of WMT has been firing on all cylinders. In markets where it is not, management is becoming proactive to limit its exposure (ASDA, WMT Japan & Brazil are few examples). After recent divestitures, international business (ex-ecommerce) appears to be in better shape and should be able to grow at 3% (~Global GDP growth rate).

In the USA, there is some concern around retail inflation, price gaps, and comping the comp. My general observation on inflation and price gaps has been that WMT continues to remain price leader in the market and given the financial health of the consumer, pricing can be robust in near future while maintaining price gaps. On comping the comp, WMT lost market share last year due to reduced store hours, consumers preferring to shop groceries closer to home, etc. All these are transitory in nature. As habits normalize, WMT will be able to regain lost market share. My base case model assumes ~2% SSS growth from US store base with modest (10bps/year) EBIT margin improvement (management has been guiding for such improvement). In nutshell, I consider the U.S. store business as a well-oiled cash machine with LSD growth prospects.

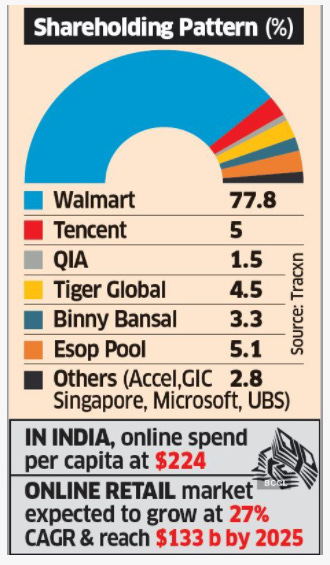

Lastly, international e-commerce continues to be another dominant force with ~$17bn in GMV in FY21. Flipkart itself grew GMV to $12bn and is expected to go public at a valuation of $40bn (>2x the price at which WMT invested). WMT’s ownership in Flipkart alone is 8% of WMT’s market cap, with PhonePe ($5bn valuation) contributing another 1.5% of WMT’s market cap. Flipkart’s public listing can be a near term catalyst for WMT stock.

I apologize, if this is a very short discussion on the core business. I believe that core will continue to chug along and the major re-rating for the stock will depend on e-commerce opportunity and profitability of e-commerce business.

Valuation

WMT shares have re-rated in past 5 years as the management has been able to demonstrate progress towards creating an omni-channel retailer. WMT currently trades at <22x 2023E EPS. I expect WMT to grow its EPS at LDD over next 5 years. If US e-commerce reaches $100bn in GMV by FY2026 then WMT will be growing at ~4% per year (~1.5x of current growth rate) and the stock should re-rate from current levels. I looked at WMT’s valuation from multiple vantage points and got a consistent outcome of ~12% IRR. I like the risk/reward at current levels.

Vantage #1: High Quality Omni-Channel Retailer: Home Depot has consistently traded at 24x-25x forward earnings (before recent correction) and has proven itself to be a true omni-channel champion amongst traditional retailers. I believe WMT is turning out to be a similar story, and can re-rate to 25x forward earnings, providing ~27% returns over next 2 years ($175 price), and combined with 1.5% dividend yield provides 30% TSR.

Vantage #2: Long Duration Story: WMT is a long duration story, with e-commerce GMV growth creating an opportunity for big re-rating in the stock as marketplace attains scale. I don’t expect WMT to become AMZN, but we are not even paying for that either. Valuing US e-commerce sales at 4x sales (conservative given where other mid-teen growth e-commerce peers are trading), international e-comm business at 2x international e-comm revenues, and traditional retail at 5x-8x multiple (again very conservative) - provides an IRR of 13%.

Vantage #3: Private Equity IRR Analysis: Staying with the rationale of long-duration, my DCF model provides an IRR of 12.5% at 22x FCF exit multiple (slight premium to current FCF multiple).