In part 1 of my post on Alcon, I provided some historical perspective on Alcon (ALC) and other medical device spin-offs. In part 2 I delved into the long-run growth levers and the reasons behind my conviction that ALC can grow EBIT at 11% CAGR. In this post I will provide detailed analysis of sum-of-the-parts valuation on ALC, but before that just a quick recap of my investment thesis on the stock:

1) PanOptix driven strong AT-IOL growth supported by leadership position in surgical device market will allow Alcon to grow its surgical business ahead of market.

2) Precision 1 fills a hole in Alcon’s contact lens portfolio; flexible manufacturing system will accelerate roll-out of new lenses.

3) 500 bps EBIT margin expansion by 2025 due to favorable product mix and operating leverage. I expect EBIT growth of 11% CAGR over next 5 years.

Valuation on the stock is not necessarily cheap with Covid-19 being an additional uncertainty. The analyst who are bearish on the stock tend to compare the sales growth potential of ALC relative to the group and value the stock using the broader European MedTech peers. I believe, this presents an incomplete picture and ignores other key factors that drive multiples within medtech industry. While demographics is favorable for most medtech companies, I consider Alcon’s end market exposure (cataract) to be more defensive, with little pressure to government reimbursement cuts, and has a strong runway for growth in an oligopolistic market.

On a relative basis, the best comparable for the contact lens business is Cooper Companies (COO), and for Surgical business Carl Zeiss Meditec (AFX) is the closest peer.

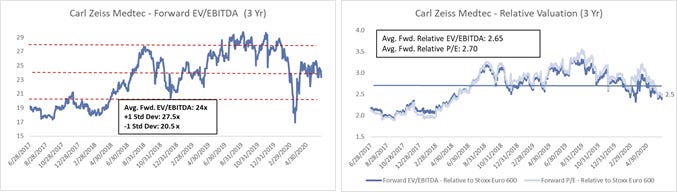

Surgical Business Multiple: Carl Zeiss Meditec derives 73% of its business from Ophthalmic Devices, this business is very similar to ALC’s surgical business – selling cataract, refractive devices, surgical consumables and IOLs. Carl Zeiss has grown faster than ALC and has been a market share gainer in the surgical market but I expect the growth gap to narrow as ALC rolls out its innovation pipeline (in fact it has already narrowed in 2018/2019). The fundamental drivers AFX’s surgical business are similar to that of Alcon’s surgical business – with a strong installed base in refractive surgery being a big competitive advantage. Carl Zeiss is trading at 23.8x 2021 EV/EBITDA multiple, which is slightly below its last 3 year average multiple – both on absolute as well as relative basis. Carl Zeiss’ mean forward multiple could be a good upper bound for ALC’s Surgical business (24x); I consider Carl Zeiss’ -1 Std multiple as a lower bound for ALC’s surgical business (20.5x).

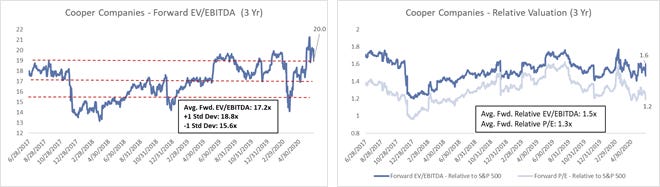

Contact Lens Multiple: The Cooper Companies (COO) gets 78% of its sales from its vision segment that sells contact lenses, which has been the primary growth engine for the company. Like Carl Zeiss, Cooper has been a net share gainer in the contact lens market, with most of the share gains coming at expense of J&J. However, this outperformance relative to Alcon will narrow but Cooper will continue to grow at a faster rate. As in the above analysis, I expect Cooper’s mean forward multiple can provide an upper bound for Alcon’s Contact Lens business (17.2x), while its -1 Std Dev multiple (15.6x) can be an appropriate lower bound given the narrowing outperformance gap between the vision care division of two companies.

Ocular health business is similar to a typical consumer health business with 2% organic growth and high OTC exposure. It is difficult to find a comparable for ocular health. Therefore, I have looked at precedent transactions in consumer health, and have adjusted the multiple for a typical 30% deal premium to arrive at 13.1x EV/EBTIDA multiple for the ocular health business.

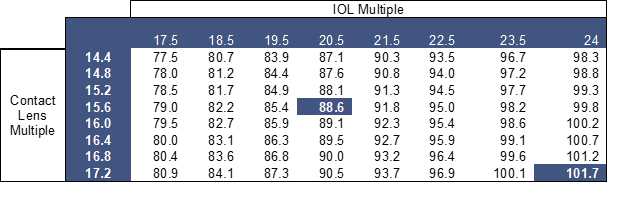

ALC’s current 2021 EV/EBITDA multiple of 18.5x (on my numbers) is very close to the lower bound multiple. I believe the current multiple is appropriate and justified and conservative given the fundamentals of the stock, therefore, my base case valuation does not assume any multiple re-rating on the stock. My 2023 price target of $89 is arrived by using SOTP valuation using lower bound multiples for Surgical, Contact Lens, and Ocular Health business. This yields a 13.3% IRR (including dividends).

This sensitivity table shows what will be ALC’s 2023 valuation if you play around multiples for contact lens and surgical business (keeping ocular health multiple at 13.1x).

DCF Valuation: Base case DCF valuation gives an intrinsic value of $67, which if I compound at WACC of 8% over the next 3.5 years provides a price target of $88. Also, in the base case Alcon will be able to compound EPS at 14% CAGR (I assume modest amount of buyback) between 2021 and 2025 (2021 growth rate is calculated using 2019 as base). Similar to SOTP valuation, I believe that the current 2021 P/E multiple of 28 can be justified using a blended average of Carl Zeiss (33x – lower bound), Cooper Companies (20x – lower bound), and consumer health/consumer staples multiple for Ocular Health (18.5x). Therefore, my base case assumes that Alcon can sustain its current multiple, while compounding EPS at 14% over the next 5 years.

Key assumptions of my model are highlighted below:

An Improving FCF Profile: ALC’s FCF conversion and FCF margin has been weak due to one-time costs, as well as higher capex intensity following a period of investments in 1) new manufacturing lines, primarily for contact lenses; and 2) standalone ERP systems. Given the timing of one-time separation costs (US$250mn over 2019 and 2020) and of capex investments (largely 2019 and 2020-focused), I expect the FCF to improve after 2020.

Summary: Alcon started publicly trading in April 2019 after being spun out from Novartis. Alcon consistently underperformed under Novartis as device innovations were stifled and persistent execution issues led to poor customer service, supply chain hiccups etc. However, since 2016 company has aggressively reinvested in the business to reinvigorate innovation pipeline and top-line growth. Organic growth has already inflected on back of multiple product launches, and the cost structure is set to normalize over the next few years. Driven by several existing product launches, strong innovation pipeline and end market tailwinds, I expect Alcon to compound earnings at 14% CAGR over the next 5 years. I value the company using SOTP, and DCF – I believe the current multiple at which Alcon trades can be sustained given the growth prospects of the business.